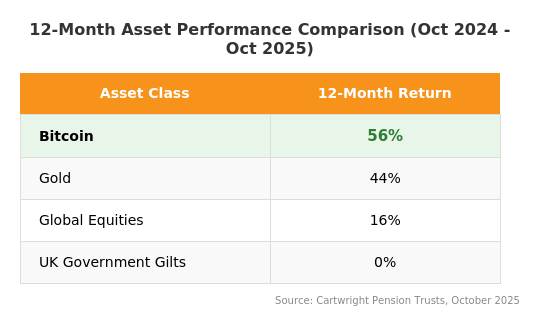

Key Finding: The first UK pension fund to allocate to Bitcoin has achieved a 56% return in the 12 months since its initial investment, significantly outperforming traditional asset classes including gold (44%), global equities (16%), and UK government gilts (0%).

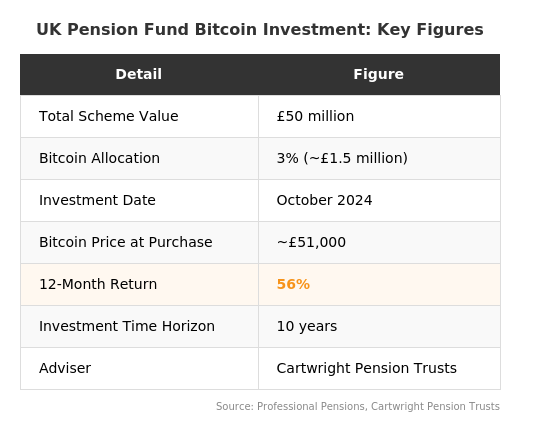

Investment Details: The unnamed £50 million defined benefit pension scheme made a 3% allocation to Bitcoin in October 2024, equivalent to approximately £1.5 million, following advice from specialist consultancy Cartwright Pension Trusts.

Wider Context: This landmark investment demonstrates how Bitcoin's fixed supply of 21 million coins and its asymmetric return profile can provide meaningful diversification benefits for institutional investors with long-term horizons.

Overview

A UK pension fund has made history. The first British retirement scheme to invest in Bitcoin has seen returns of 56% in just one year. This result has beaten gold, stocks, and government bonds by a wide margin.

The unnamed scheme, worth £50 million in total, put 3% of its money into Bitcoin in October 2024. That works out to about £1.5 million. One year later, that investment has grown by more than half its original value.

This news comes at a time when many people are asking whether Bitcoin belongs in serious investment portfolios. For pension savers wondering about Bitcoin price movements and long-term Bitcoin value, this real-world example offers important lessons.

What Happened

In October 2024, a defined benefit pension scheme became the first in the UK to hold Bitcoin directly. The scheme was advised by Cartwright Pension Trusts, a firm that helps pension funds with their investments.

The trustees chose to put 3% of the fund into Bitcoin. This was not a rush decision. According to Cartwright, the allocation came after a rigorous training and due diligence process. The trustees looked at the risks and rewards carefully before moving forward.

At the time of purchase, Bitcoin was trading at just above £51,000. The investment was made just weeks before the US election in November 2024. Since then, Bitcoin has reached several new all-time highs, pushing the Bitcoin price well above £80,000 at its peak.

The Results After One Year

As of 22 October 2025, the scheme's Bitcoin holding had grown by 56%. Sam Roberts, Director of Investment Consulting at Cartwright, called this a significant boost to the scheme's overall funding position.

To put this in perspective, here is how Bitcoin compared to other asset classes over the same 12-month period:

The numbers show that Bitcoin delivered returns more than three times higher than gold and more than three times higher than global stocks. UK government bonds, meanwhile, provided no return at all.

Why the Trustees Chose Bitcoin

Cartwright explained that several factors made Bitcoin attractive for this particular scheme:

Asymmetric return profile: A small allocation to Bitcoin can have a big positive impact on returns, while the downside risk is limited to the amount invested.

Long investment horizon: The scheme has a 10-year time frame. Bitcoin's volatility matters less when you can wait out the ups and downs.

Diversification: Bitcoin behaves differently from stocks and bonds. Adding it to a portfolio can reduce overall risk.

Inflation protection: With only 21 million Bitcoin ever to exist, the currency cannot be devalued through money printing like pounds or dollars.

Low counterparty risk: Unlike many investments, Bitcoin does not depend on banks, governments, or companies to keep their promises.

How the Investment Was Made

The pension scheme did not buy Bitcoin through an exchange-traded fund or other indirect method. Instead, it bought and held Bitcoin directly. This is important because it means the scheme actually owns the Bitcoin, rather than owning shares in something that tracks Bitcoin's price.

According to Cartwright, the operational procedures were designed to maximise security whilst allowing profits to be taken quickly when needed. The scheme used specialist Bitcoin custody from Onramp, with Zodia Markets handling the trading.

Steve Robinson, Head of Investment Implementation at Cartwright, noted that the solution has a low minimum investment threshold. This means smaller pension schemes can also access Bitcoin if they choose to.

What the Experts Say

Sam Roberts of Cartwright stressed that Bitcoin is not right for every scheme. However, he believes it deserves to be part of the conversation.

Roberts said: "It's still early days, and this remains a long-term investment, but one year on and we now have an objective example of what pension schemes could achieve if they're willing to think differently."

Cartwright estimates that the Bitcoin allocation had the potential to bring the scheme's buyout horizon forward by as much as two years. At the same time, the firm said that portfolio volatility was estimated to rise by only 2% due to the small allocation size.

The Wider Picture

While this UK scheme remains a pioneer, pension funds in other countries have been quicker to adopt Bitcoin. The State of Wisconsin Investment Board in the United States recently sold its Bitcoin holdings after making approximately $200 million in profits. The state of Texas has also invested $5 million in Bitcoin as part of its treasury reserves.

These moves follow the approval of spot Bitcoin ETFs by the US Securities and Exchange Commission in January 2024. This decision made it easier for large institutions to gain Bitcoin exposure through familiar investment vehicles.

Cartwright says it is now in discussions with several other pension schemes about Bitcoin allocations. Arash Nasri, a senior investment consultant at the firm, told Decrypt that there is growing interest from corporations and charities as well.

Key Figures at a Glance

Risks to Consider

It is important to note that Bitcoin remains a volatile asset. Since reaching highs above £80,000, the price has fallen back to around £68,000 at the time of writing. This kind of price swing is normal for Bitcoin and shows why it is only suitable for investors who can take a long-term view.

Roberts acknowledges this, saying: "It won't be the right fit for every scheme, but it deserves to be part of the conversation. The fact that it's now a legitimate option on the table is, in itself, a solid step forward."

For those watching Bitcoin value and wondering whether now is a good time to buy cheap Bitcoin, this pension fund story shows that timing the market matters less than time in the market. The trustees did not try to predict short-term price movements. They made a strategic decision based on Bitcoin's long-term fundamentals.

What This Means for the Future

This pioneering UK pension scheme has provided real-world evidence that Bitcoin can play a role in institutional portfolios. The 56% return in one year has made a tangible difference to the scheme's funding position.

Cartwright expects more pension funds to follow. The firm compares the current moment to when pension schemes first started investing in equities in the 1970s, or high yield bonds in the 1980s. New asset classes often take time to gain acceptance, but eventually become standard parts of portfolio construction.

For everyday savers and investors, this news highlights an important trend. Major institutions are starting to treat Bitcoin as a legitimate asset class. As more pension funds, corporations, and governments add Bitcoin to their holdings, the case for individuals to understand and consider Bitcoin grows stronger.

Sources

Professional Pensions, 'Unnamed scheme becomes first in UK to allocate to Bitcoin', November 2024. Original reporting on the pension scheme's Bitcoin allocation.

Professional Pensions, 'First scheme to make Bitcoin allocation posts first year return of 56%', December 2025. Update on the scheme's one-year performance.

Pensions Expert, 'Pension fund records 56% gain from bitcoin allocation', December 2025. Industry analysis of the scheme's returns.

Cartwright Pension Trusts, Official press release and statements from Sam Roberts and Steve Robinson, October 2024 and October 2025.

Decrypt, 'UK Pension Firm Sees Growing Interest in Bitcoin Exposure', July 2025. Interview with Arash Nasri of Cartwright.

IPE (Investment & Pensions Europe), 'First UK pension fund allocates to bitcoin', November 2024. Industry coverage and expert commentary.

Zodia Markets, 'UK pension fund Bitcoin allocation is reshaping institutional thinking', October 2025. Analysis of the investment structure and custody arrangements.